Steps for home buying success

- Fico score: the better your score, the better the rate and monthly PMI

- Work history: have you been working in the same field for the last two years?

- Down payment: have you saved up a down payment or will you require down payment assistance?

- Borrowers: will you be the only person on the loan or will you have a co-borrower?

- Debt: the less debt you have, the more purchasing you’ll have.

- The area – schools, crime rate, amenities, distance to family and work.

- Purchase price – check the sold price of similar homes for the last 3 months. Is the home priced right?

- Market rent – if I don’t buy a home, how much would it cost me to rent? Compare if buying is a better option.

Add your total net income.

Subtract all your expenses.

How much do you have left?

With the remaining balance, what mortgage payment will you be comfortable with?

Do you have money left to save? Money left to vacation? Money left to maintain your lifestyle?

Talk to homeowners: best friend, neighbors, boss, coworkers, siblings. Get their experience of being a homeowner & the home buying process.

*Just make sure you don’t become your own worse enemy. Keep in mind that your situation and your timing is different from theirs.

- Google “loan officer in your city“

- Go to your local bank

- Get a referral from your sphere of influence

- Utilize www.findamortgagebroker.com

- Find someone who’ll take their time to address your questions and explain the mortgage jargons you see and hear during the homebuying process.

If you don’t want your credit pulled, pre-qualify with your loan officer. Everything is done verbally. Questions I ask:

- Have you worked for at your current job for two years?

- What’s your hourly pay?

- Do you work 40 hours per week?

- Do you get paid weekly, bi-weekly, semi-monthly, or monthly?

- What is the monthly payment for the following liabilities (if applicable): car loans, all your credit cards, student loans, child support, alimony, personal loans, etc.

- What’s your fico score?

- How much do you want to put down?

- What zip code are you looking to buy?

Once you’re ready to buy, get pre-approved. Now I need to verify that what you told me is true.

I’ll need:

- Two most recent pay stubs

- Two most recent W2s

- Bank Statements to show proof of funds

- ID

- Email address

- Hard Credit Pull

- Completed Loan Application

- Google “realtor in your city“

- Get a referral from your sphere of influence

- Get a referral from your loan officer

Provide your house requirements

- Great school

- Must have pool, RV parking, or 3 car garage

- No HOA

- No mellaroos

- House number must not add up to 13 (whatever you want)

Your realtor will provide you comparable sales in the area, be knowledgeable about the area, keep or remove contingencies, recommend an offer amount, and get your final approval for your offer.

Remember: your realtor, like your loan officer, works on your behalf and should provide the best possible recommendation

When you find your house, your realtor will draw up your offer utilizing a Residential Purchase Agreement (RPA). When your offer is submitted, a few things can happen

Offer can be rejected, counter, multiple seller counter offer, or accepted.

- Rejected: The sellers did not like your offer.

- Counter: The sellers like your offer, but they want to adjust your offer before accepting.

- Multiple Seller Counter Offer: The sellers are choosing multiple buyers and adjusting their offers individually. The sellers will then still be able to decide which offer they’ll choose from that batch of buyers.

- Accepted: You are now in escrow or contract and you must close your loan by the agreed upon time.

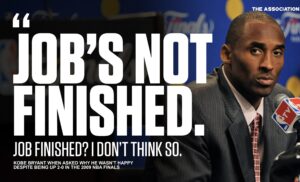

Remember to hold your “Thank you” till the end. Like the late and great Kobe use to say, “Job’s not finished.”

- Your contract will be sent to your loan officer.

- Your application, along with all your documents, will be submitted to the underwriter for review.

- This is a good time to lock your interest rate, order your appraisal, order your home inspection, and search for homeowner’s insurance quote.

- Your loan will approve with conditions.

- We’ll clear conditions, by providing the documents the underwriter is asking for.

- We submit the documents and clear all conditions.

- Conditions have cleared with no new conditions being added.

- Underwriter gives us the Cleared-To-Close.

- Both realtors are notified and a signing date will be set.

- Prior to signing, I will review the final numbers with you and let you know how much you’ll need to bring to closing.

- You will sign with a mobile notary or at the Title Company’s office with their in-house notary.

- Wire your money & wait for the county to record.

- You don’t get your keys until the county records.

- County has recorded your transaction.

- Congratulations.! You are officially a homeowner. Go get your keys from your realtor.